What Does Face Amount Of Life Insurance Mean

The face value never changes. In most cases the difference between your.

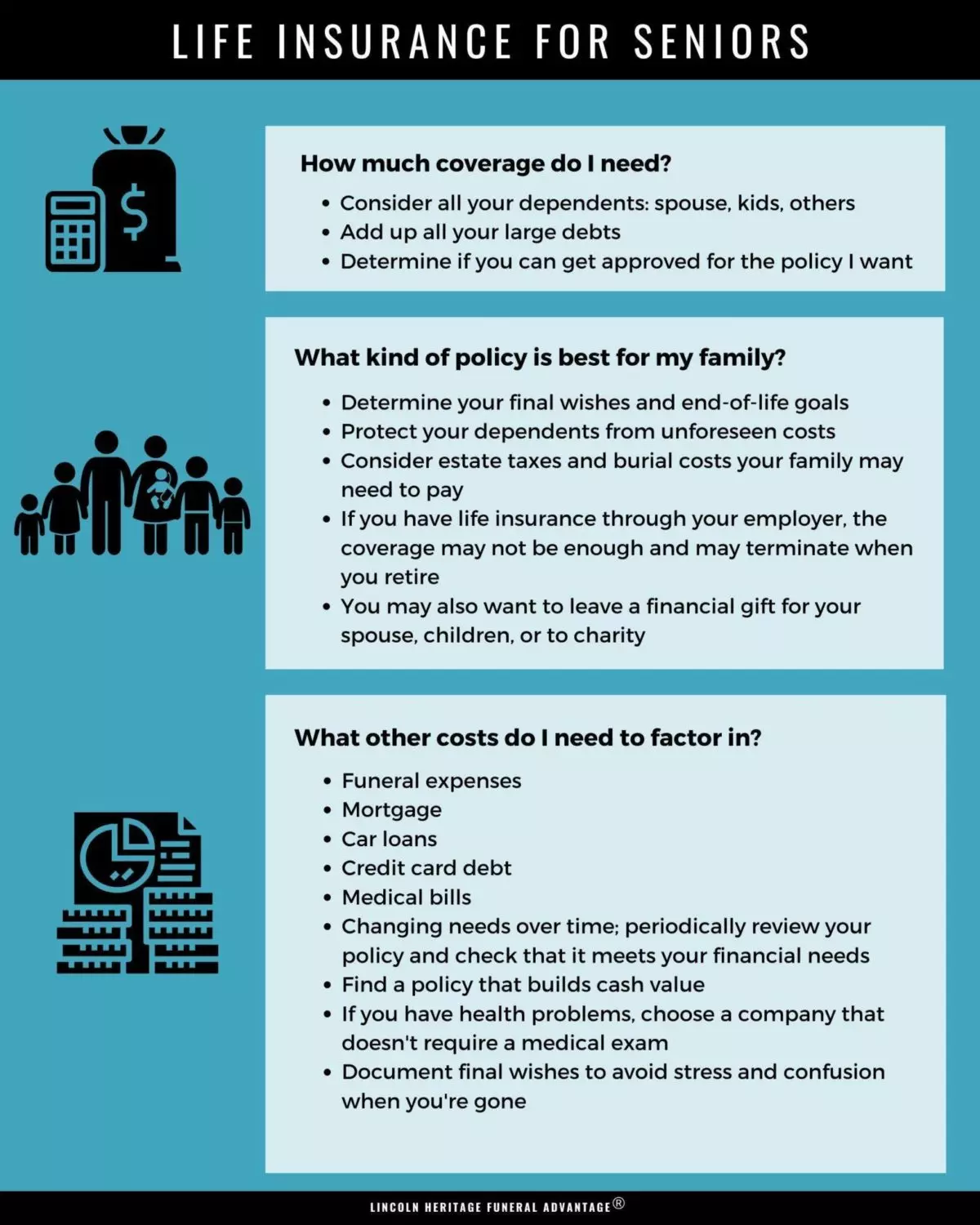

Best Life Insurance For Seniors

It is used for life insurance policies.

What does face amount of life insurance mean. Term life insurance is one of the most affordable types of life insurance. The face amount is stated in the contract or application. Cash value or account value is equal to the sum of money that builds inside of a cash-valuegenerating annuity or permanent life insurance policy.

The face amount almost always equals the death benefit in term insurance. The face value or face amount of a life insurance policy is established when the policy is issued. The amount of money that your insurance provider puts toward the policy is known as the face value and is the amount that will be paid out to your beneficiaries when you pass away.

A life insurance policy has a face value and a cash value and they are two different numbers. What is the difference between face amount and death benefit. However as time goes by they can begin to diverge.

Face amount is the gross total amount of cash quantified in an agreement or insurance policy. Choosing a life insurance company. They both reflect the amount of money that the insurance company will pay out in the case of a valid claim.

The cash value is often stated on the top sheet of the policy hence the name face amount. It is often easier to qualify for than an individual life insurance policy but doesnt provide the amount of coverage most people need. Its the amount of death benefit purchased which indicates the amount of money the policy will pay to the beneficiary or beneficiaries when the insured person dies.

If you designated a life insurance payout of 750000 then the face value of your policy is 750000. 1 Answer At the beginning of the policy the face value and the death benefit are the same. The really simple answer is that the face amount of a policy is simply its death benefit.

This is the dollar amount that. The face value of a whole life insurance policy is also known as the death benefit of the policy. On the contrary the death benefit is the amount of money that is paid to a beneficiary by an insurance company.

In the case of a typical level term life insurance the Face Amount is the amount of insurance for the guaranteed length of time. The company may pay the face amount to the beneficiary in a variety of methods. Sum of money for which an insurance cover is obtained usually shown on the top sheet face of the policyIn life insurance face amount is the sum paid on the policys maturity date on the death of the insured or if the policy terms permit on his or her total disability.

Face value or par value is the dollar value of a bond or note generally 1000. The policyholder determines the term of the life insurance policy which typically ranges from 10 to 30 years and can increase in 5-year increments. How When They Differ.

Face amount is the amount stated on the policy that will be paid to the beneficiary in the event of the death of the insured or maturity of the policy. Term life insurance is a life insurance policy that covers the policyholder for a specific term or amount of time. The cash value on the other hand is the policys accumulated cash value or cash surrender value that the policy owner can use for whatever purpose heshe desires either while the policy remains in force or after canceling the policy.

That is the amount the issuer has borrowed usually the amount you pay to buy the bond at the time it is issued and the amount you are repaid at maturity provided the issuer doesnt default. The face amount in life insurance means the amount of insurance you buy. The face amount is what most people talk about when they discuss their life insurance policy.

A life insurance calculator takes into account your funeral costs mortgage income debt education to give you a clear estimate of the ideal amount of life insurance coverage. The death benefit is the amount that is actually paid to the beneficiary when death occurs. The face amount is the purchased amount at the beginning of life insurance.

Group coverage is best utilized as supplemental life insurance. The face value of your life insurance policy is the amount that is paid out to your beneficiaries when you die. Life insurance coverage offered by an employer union or organization.

In the case of whole life insurance the Face amount is the initial death benefit that can fluctuate for numerous contractual reasons. The face value is the death benefit.

What Is Term Life Insurance And How Does It Work Money

How Does Whole Life Insurance Work Costs Types Faqs

Life Insurance Over 70 How To Find The Right Coverage

2021 Final Expense Life Insurance Guide Costs For Seniors

Best Life Insurance For Children Valuepenguin

12 Questions To Ask About Whole Life Insurance Policies White Coat Investor

Can Life Insurance Be Cashed In Before Death Life Ant

Variable Life Insurance Policygenius

Difference Between Cash Value And Face Value In Life Insurance

What Is Life Insurance And How Does It Work Money

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition

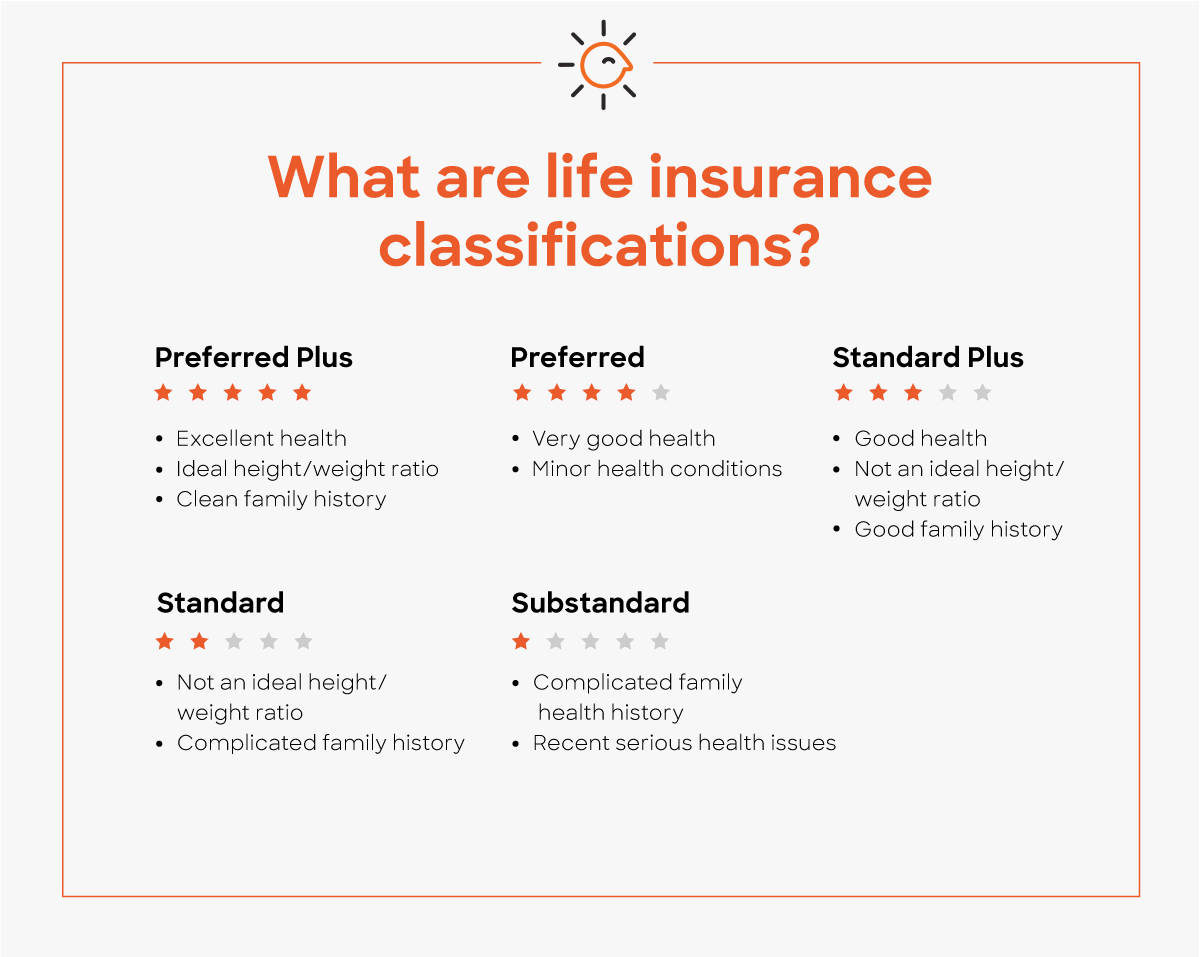

Understanding The Life Insurance Medical Exam Policygenius

Term Vs Whole Life Insurance Policygenius

How Does Life Insurance Work Forbes Advisor

Is A Straight Life Policy Right For Me Paradigmlife Net Blog

What Are The Three Main Types Of Life Insurance The Insurance Pro Blog

What Is Guaranteed Issue Life Insurance

Age 100 Tax Issue With Outliving Life Insurance Mortality Tables

:max_bytes(150000):strip_icc()/GettyImages-1199059338_journeycrop_lifeinsurance-d3498103ef78406991ea4b4a7b401266.jpg)

Post a Comment for "What Does Face Amount Of Life Insurance Mean"