Is Hospital Indemnity Insurance Worth Getting

Hospitalization is expensive on its own but its easy to overlook the additional costs you can incur while youre hospitalized. Get Free Medicare Help.

Is Hospital Indemnity Insurance Worth It Glg America

Common ER procedures can cost as much as 17797.

Is hospital indemnity insurance worth getting. But this is a GOOD thing. Fixing a broken leg can cost up to 7500. Guardian Hospital Indemnity Insurance provides a core hospital admission benefit that covers members who are admitted to a hospital or intensive care unit ICU because of a covered sickness or injury.

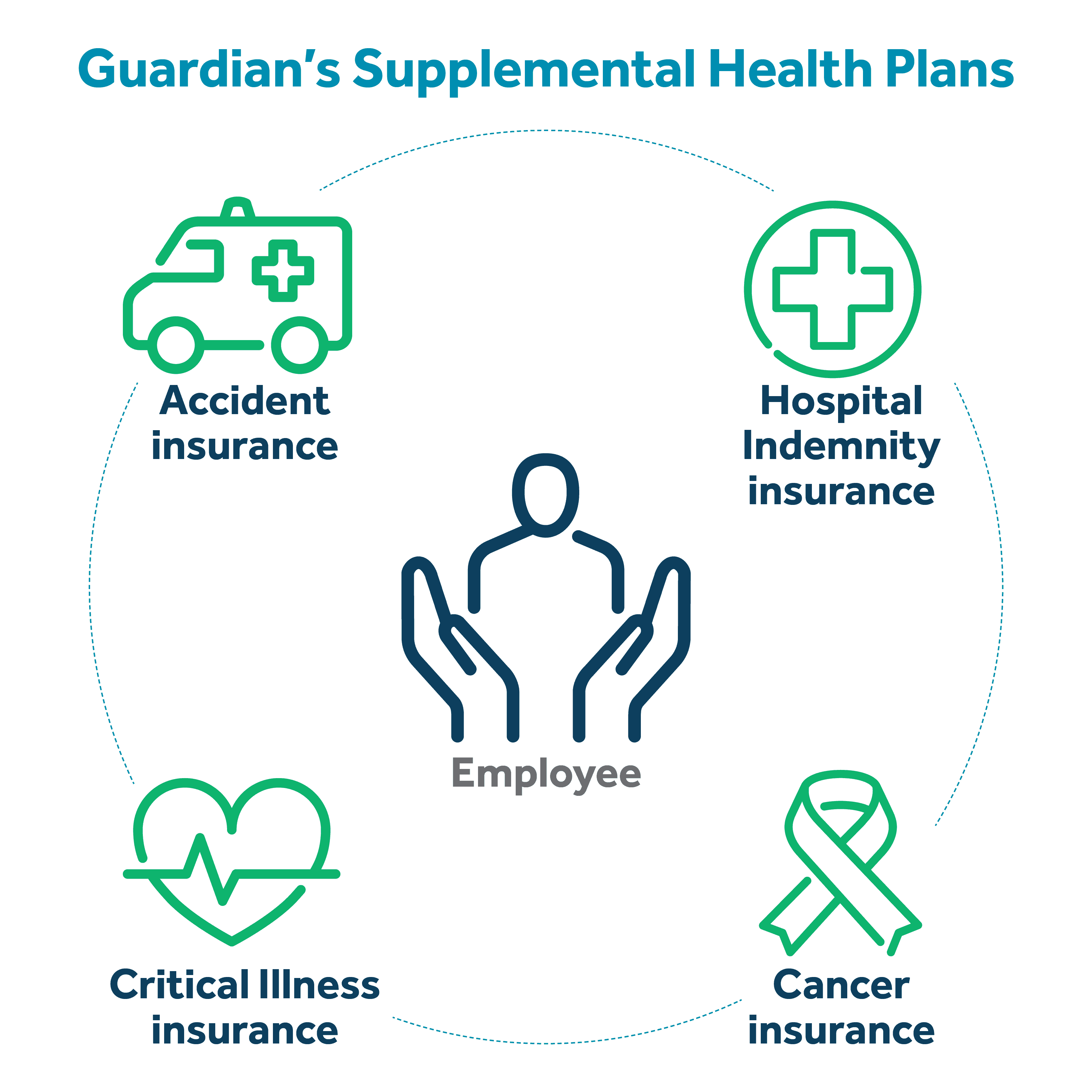

Hospital indemnity insurance is meant to supplement your medical insurance not replace it so its as important to understand what it wont cover as what it will. The cost for our plan is 20 pre-tax biweekly. You can help your clients customize a plan to complement other Guardian supplemental health products or plans from other providers.

In some of my reading up on the subject I read that hospital stays cost upwards of 10k on average though I would expect her Blue Cross Blue Shield PEEHIP shes a teacher in Alabama to cover most of the cost of a stay. Accident insurance and hospital indemnity policies are secondary health coverage options you can purchase to help alleviate medical costs your primary insurance policy might not cover. The average cost of a hospital stay for a heart attack is 20086.

Its Not Health Insurance But It Makes Health Insurance Better. In 2018 the average inpatient hospital stay was 2517 according to the Kaiser Family Foundation. What is hospital indemnity insurance.

It is a type of supplemental insurance. By contrast hospital indemnity insurance triggers payments when specific events associated with hospital visits occur. However its up to you to research which type of coverage is most suitable for your needs.

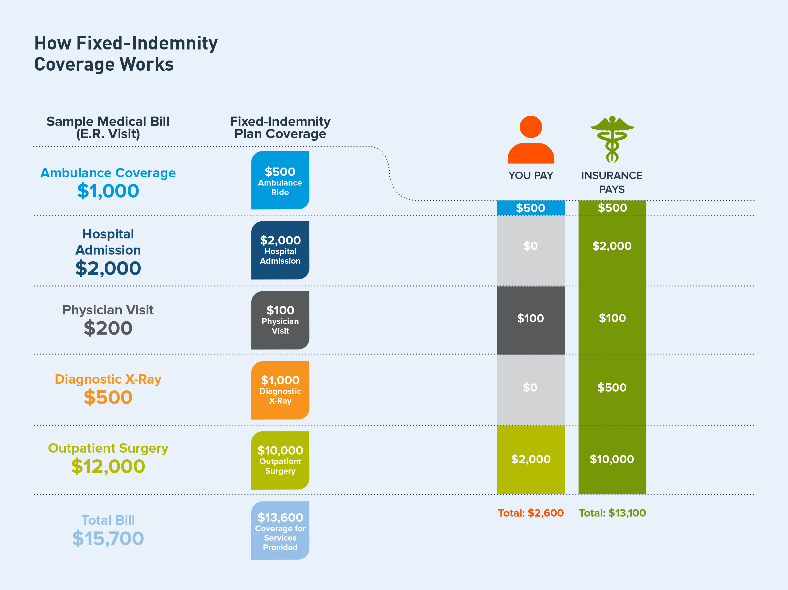

For example 1000day for each day in a hospital. It can help cover out-of-pocket hospitalization costs that Original Medicare or a Medicare Advantage plan will not. Unlike medical insurance that pays your provider hospital indemnity insurance pays a lump sum directly to you.

That means its designed to complement traditional health insurance not replace it. If you dont go to the hospital then no benefits are paid. Is Hospital Indemnity insurance worth it and what does Hospital Indemnity pay for.

Even physicians can benefit from hospital indemnity insurance. Hospital indemnity typically pays a set schedule. What does it pay for.

On my own I never thought indemnity would be helpful but my wifes family has a history of some serious illnesses. Sure you may need to spend a little more each month but knowing that your health care deductibles copays and coinsurance are completely or nearly covered should give you peace of mind. And you can.

Hospital Indemnity is an option that you can add to your overall health insurance portfolio. Depending on your situation one may be better for you than the other. Is Hospital Indemnity Insurance Worth Getting.

We feel that hospital indemnity insurance is worth the money. Hospital indemnity insurance is a supplemental medical insurance plan that pays cash directly to you if you have to go to the hospital. When you bring up hospital indemnity insurance your new or existing clients may ask Is hospital indemnity worth getting The answer in many cases is Yes Hospital indemnity policies can be sold to people of any age and are a great option for any individuals or families who are concerned about high copays and out-of-pocket costs.

Hospital indemnity insurance is an additional insurance policy you can buy that pays you a fixed amount for each day you spend in a hospital. With a comprehensive health insurance plan you are still responsible for copays and coinsurance. All you have to do is submit your bills showing you were in the hospital and youll get the benefit.

Why You Should Consider Getting Supplemental Hospital Indemnity Insurance 11 May 2015 According to the Agency for Healthcare Research and Quality a hospital stay costs around 7400 for 18 to 44 year olds and 12500 for 45-64 year olds. In our opinion it is a safety net preventing you from experiencing potentially high out-of-pocket costs with your health care. Health insurance pays for specific medical services after deductible or copayment amounts are satisfied.

For people with private health insurance the out-of-pocket cost for a hospital stay is more than 1000. Hospital indemnity insurance is a type of policy that helps cover the costs of hospital admission that may not be covered by other insurance. While every hospital indemnity plan is different youll probably see three core types of benefits especially in group plans offered at work.

And the best part is that you can use the money however you need to whether its to cover household bills medical insurance deductibles or even a special treat for your child who just got home from the hospital. Hospital indemnity insurance is a type of health coverage plan designed to cover hospital stays. It wont pay medical bills from your doctors or hospitals nor will it pay for your medications from the pharmacy.

It pays you a specified amount for each day of covered service you receive no matter what the final billed charges are. The average hospital stay costs over 10700.

What Is Hospital Indemnity Insurance And Do I Need It American Income Life Insurance Co

Dangers Of Fixed Indemnity Plans But Not In The Eyes Of The Court Triage Cancer Finances Work Insurance

4 Facts You Need To Know About Hospital Indemnity Insurance

Making Hospital Indemnity Part Of The Mix

Hospital Indemnity Insurance The Hartford

4 Facts You Need To Know About Hospital Indemnity Insurance

What S The Difference Between Hospital Indemnity Policies And Accident Insurance Sbma Benefits

How Does Hospital Indemnity Insurance Work With Medicare Medicarefaq

Indemnity Health Insurance Plans Allow You To Choose The Doctor Healthcare Professional Hospital Or Servi Health Insurance Plans Health Insurance Health Site

Home Insurance 7 Benefits You Might Not Know Home And Auto Insurance Home Insurance Business Insurance

What S The Difference Between Hospital Indemnity Policies And Accident Insurance Sbma Benefits

Dangers Of Fixed Indemnity Plans But Not In The Eyes Of The Court Triage Cancer Finances Work Insurance

Hospital Indemnity Insurance The Rough Notes Company Inc

Hospital Indemnity Insurance Guardian

Have Kids Hospital Indemnity Insurance Youtube Indemnity Insurance Children Hospital Insurance

It S Important For Small Business Owners To Remember That The Costs Associated With Providing Health Insurance Employee Health Business Owner Health Insurance

Learn More About Health Protectorguard Fixed Indemnity Insurance Youtube

Professional Indemnity Insurance Professional Indemnity Insurance Insurance Indemnity

Post a Comment for "Is Hospital Indemnity Insurance Worth Getting"