Life Insurance Underwriting Classes

Use our free comparison tool below to find quotes. That is why Equitable Lifes Term insurance policies offer five Classes of Risk or Underwriting Classifications based on the health of individual clients.

Life Insurance Underwriting Classes Explained Forbes Advisor

Nonsmokers can pay as low as 25month while smokers could pay 98month for Preferred Plus life insurance.

Life insurance underwriting classes. The risk classification also known as a risk class is used to determine the premium on your life insurance policy. Needy Insurance No Result. Commercial Underwriting Basics Course.

Life Insurance Underwriting Classes. Each insurance company has its own underwriting guidelines they follow to evaluate the risk and calculate prices. The premiums you pay for life insurance will ultimately depend on.

Its important to note that not all carriers follow the same classes for the same illness. Life insurance rate classes are part of the life insurance underwriting process with every insurance company. No matter the field of study students should complete Risk Management courses.

During the life insurance underwriting process you will be eventually assigned an insurance risk classification that will determine the actual cost of your policy. Sunday May 30 2021. Life Insurance Underwriting Classes Explained Forbes.

Students learn about insurance underwriting in a section of the class devoted to life insurance fundamentals. Underwriting is the process the life insurance company uses to approve or deny a policy application. Health insurance and liability coverage are also typically discussed.

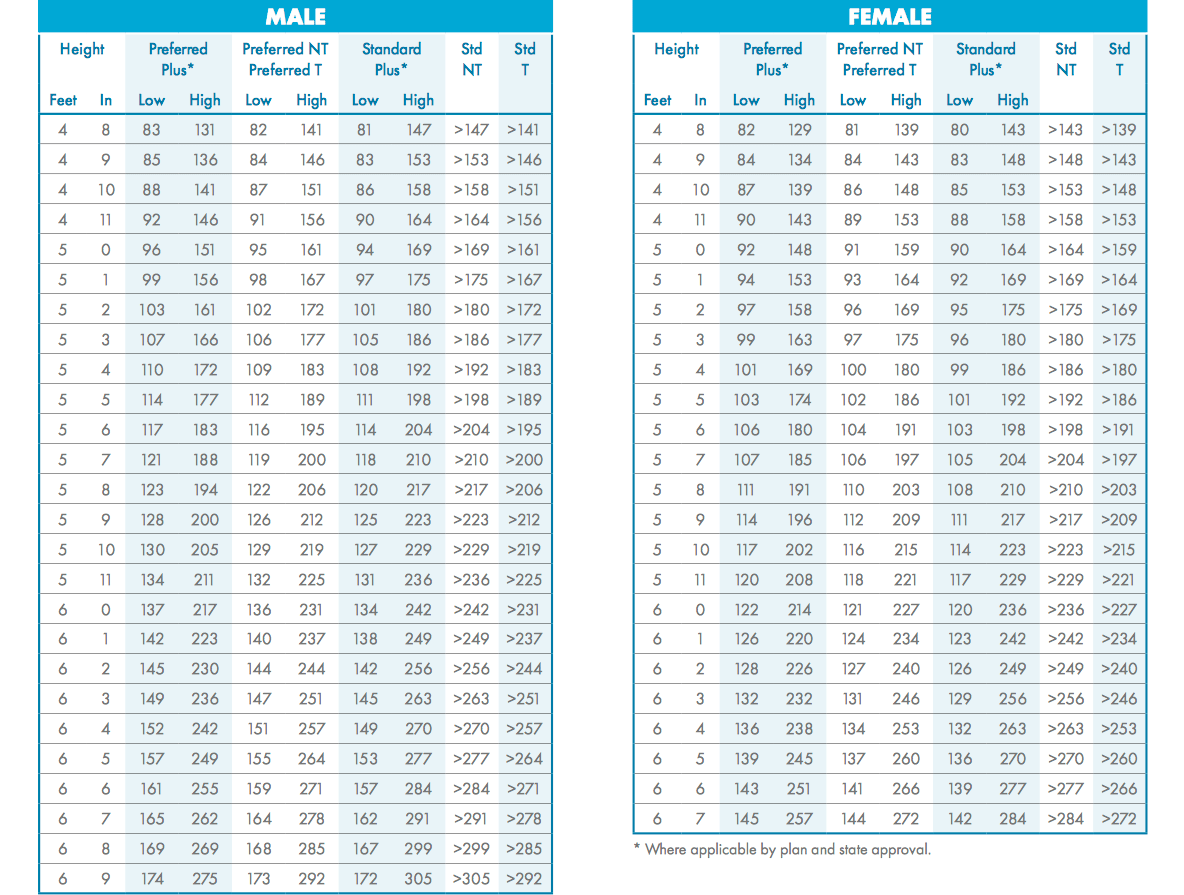

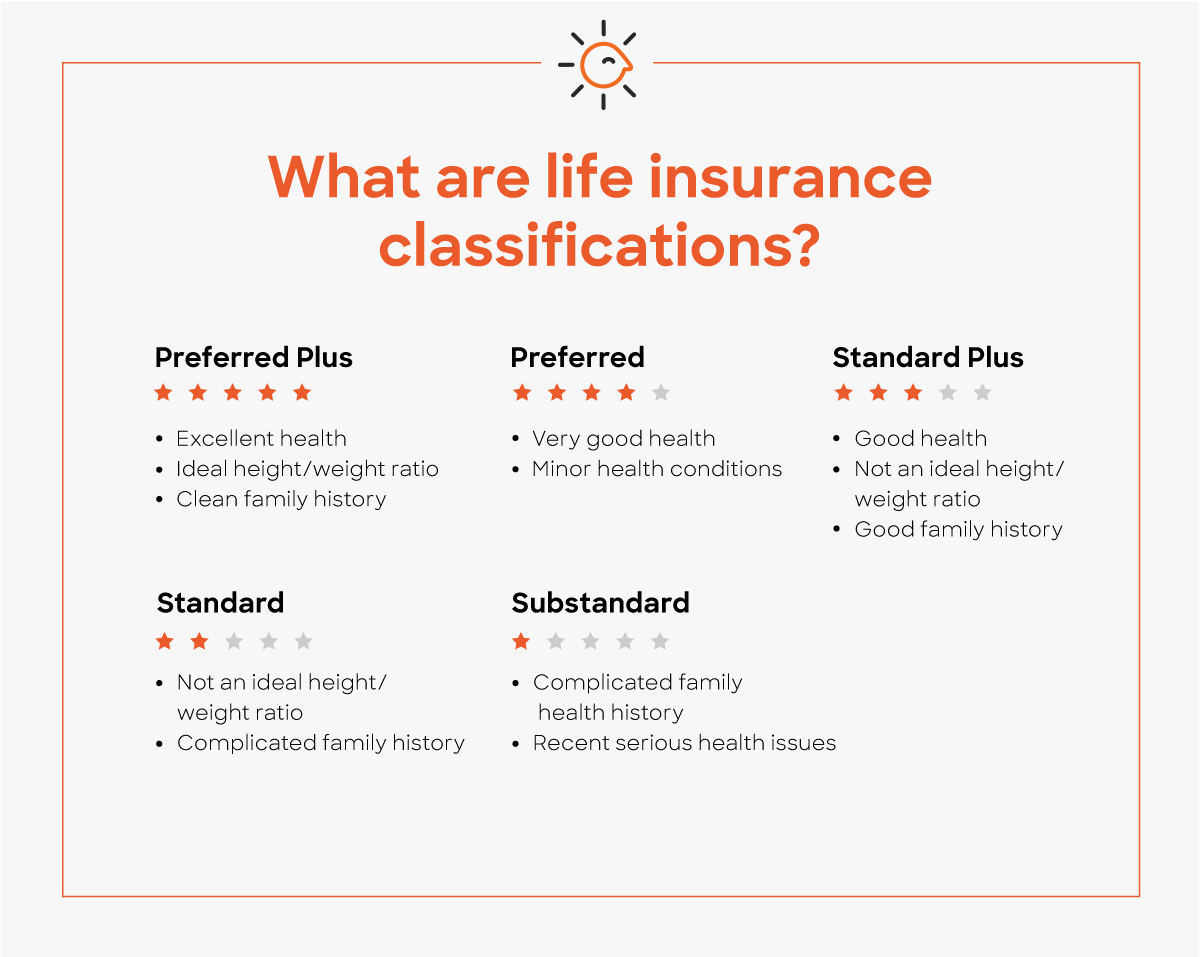

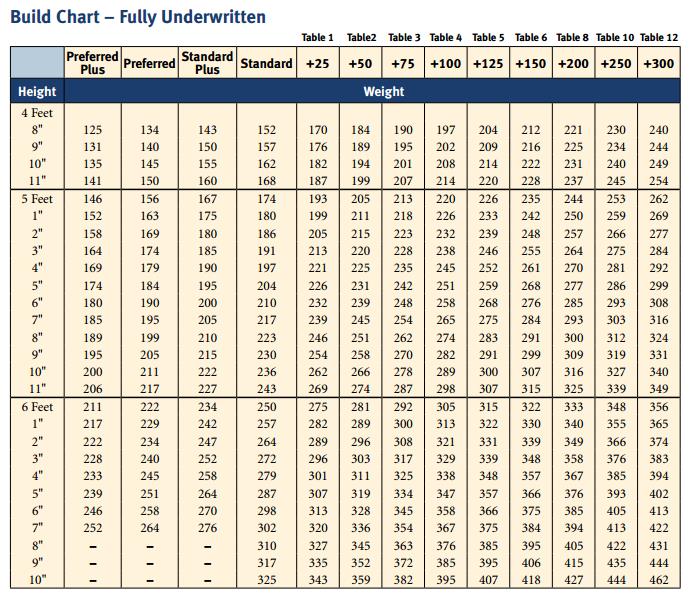

The classifications are Preferred Plus Preferred Standard Plus Standard and Substandard. Life insurance underwriting is the process of a carrier determining how likely your client is going to die while the policy is active. Underwriting Criteria - Standard Classes 13 Build Chart 14 Credit Program 15 Retention and Reinsurance 16 Large Cases 16 Temporary Insurance ApplicationAgreement TIAA 17 Good Health Statement 17 Financial Underwriting Guidance 18 Financial Underwriting - Personal Insurance 19 Financial Underwriting - Business Insurance 20 Reinstatements 21 QuickQuotes 21.

Needy Insurance No Result. It is their way of determining the risk of an individual policyholder becoming a claim. If youve looked into applying for life insurance you might have heard the terms underwriting and risk class used.

For instance if you buy term life there are 12 different classes but if you buy final expense coverage you will find two or three classes depending on the company and the product. They need to make sure that they are going to be able to afford those claims. Life Insurance Underwriting Classes Explained Forbes.

Four main factors are used to determine the total premium your age the amount of coverage the number of years the coverage is guaranteed and the risk class. Life insurance classifications are an indicator of how risky you are to insure. Life insurance companies pay massive claims out when an insured person dies.

Elite For Term Only Preferred Plus NT Preferred NT Non-Smoker Standard. Also the insurance company has the final rating classes not the broker. Life insurance carriers group people with similar mortality risks into categories called rate classes Rate classes include.

Which Risk Class Can I Qualify For. Certainly those words can sound intimidatingespecially if. For instance you may get a standard rating class with one company for elevated cholesterol and.

The underwriter will classify you based on your health risk in a category called a rating class. How is the risk class. This is also known as a clients mortality risk.

Term life insurance rates are based on the rating class assigned. This is an intermediate course taken on the path to the Associate in. The life insured is a very healthy non-smoker no smoking or cessation aids within the past 24 months with an excellent family medical history.

Some colleges may also offer courses in Property Insurance Life and Health Insurance and other topics directly related to this career. Taking Computer classes may also be helpful as Insurance Underwriters need strong computer skills. View All Result.

Look for a Job as an Insurance Underwriter Trainee. The general characteristics in determining your risk class are. View All Result.

View All Result. How youre classified dictates the cost of your premiums with Preferred Plus. How do the life insurance underwriting risk classifications work.

Examples of life insurance rating classes include Preferred Plus Preferred Standard Plus Standard and Substandard. Needy Insurance No Result. Evaluate Life Insurance coverage FirmsEvaluate Insurance policies With Eight Main Insurers Get A Quote Should youve appeared into making use.

September 24 2020 September 24 2020 Compare Life Insurance Companies Compare Policies With 8 Leading Insurers. Guardian Life Insurance Classifications Requirements The most current Preferred Class Criteria and Underwriting Requirements Guide can be applied to all individual life products currently issued directly by The Guardian Life Insurance Company of America New York NY. Class 1 Preferred Plus Non-Smoker.

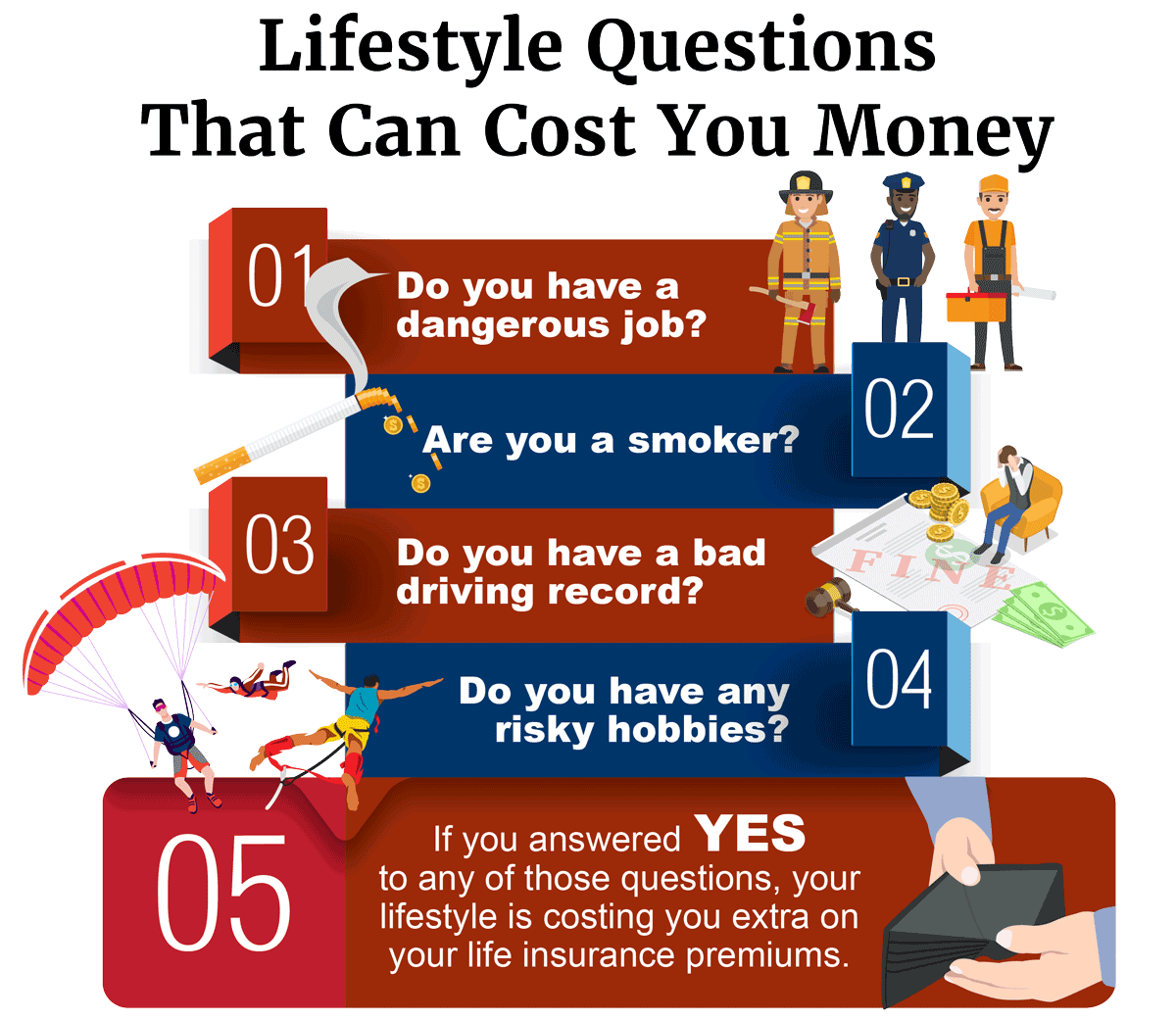

The following are some commonly offered underwriting courses that can be found online. Your hobbies health and family history are used to determine your life insurance classification.

Life Insurance Table Ratings The Ultimate Guide To Affordability

Functions Of Insurers 1 Ratemaking 2 Production 3 Underwriting Ppt Video Online Download

What Is A Substandard Life Insurance Risk Quotacy

Height And Weight Guidelines For Life Insurance

How Does Life Insurance Underwriting Work Tips That Help Riskquoter

What Are Life Insurance Underwriting Classes Haven Life

Life Insurance Table Ratings The Ultimate Guide To Affordability

Life Insurance For Diabetics Best Companies Rates Tips In 2021

What Are Life Insurance Underwriting Classes Haven Life

Top Life Insurance Companies Revealed Pricing And Ratings

Minnesota Life Underwriting Guidelines Life Insurance Shopping Reviews

Understanding Life Insurance Rate Classes Table Ratings More

Life Insurance Underwriting Guidelines Quickquote

15 Ways Underwriters Determine Your Life Insurance Premium Quotacy

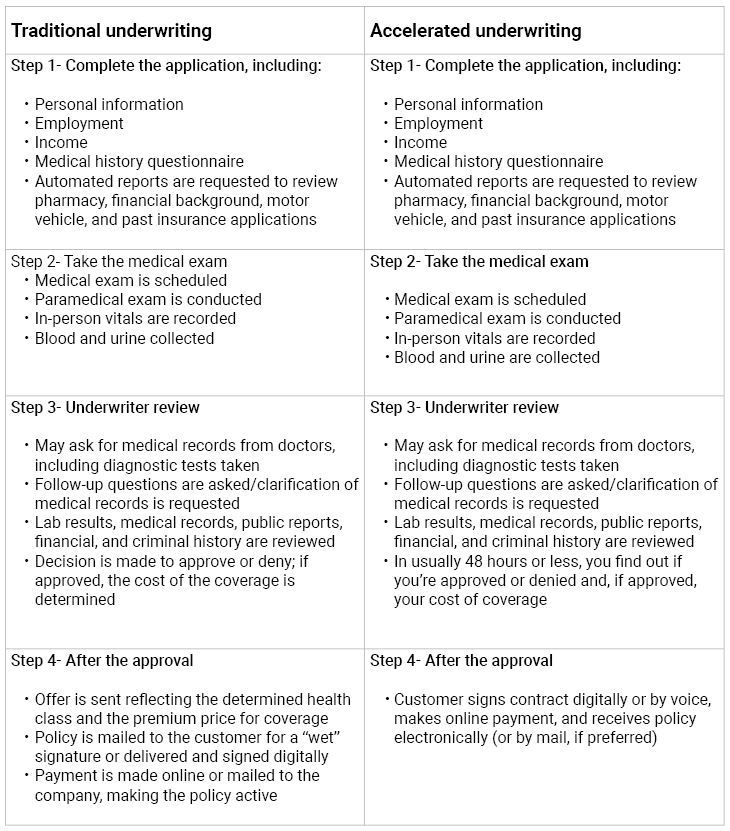

Accelerated Underwriting No Exam Life Insurance Legal General America

Top Life Insurance Companies Revealed Pricing And Ratings

Protective Life Underwriting Guidelines Life Insurance Shopping Reviews

Http Docs Crumplifeinsurance Com Documents Guardianuwfullguide Pdf

The Evolution Of Predictive Models In Life Insurance Underwriting Youtube

Post a Comment for "Life Insurance Underwriting Classes"