Life Insurance With Long Term Care Rider 2018

The price of long-term care insurance has really gone up. Are they worthwhile alternatives to traditional LTC policies.

Life Insurance Vs Long Term Care Insurance

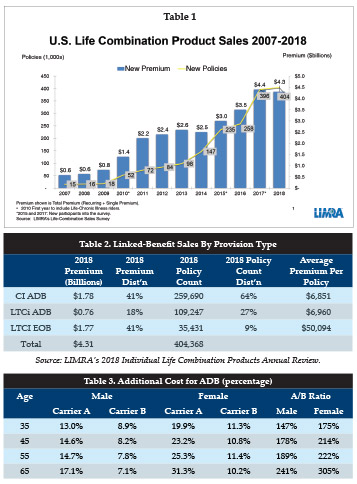

2 As these insurance products are doing double duty ie one policy or product offering the potential for two kinds of coverage their premiums are costlier than that of a standalone LTC policy.

Life insurance with long term care rider 2018. Some insurers now offer cash rich whole life insurance policies with an option to add long-term care benefits. So if you have a 250000 life insurance policy the most youd be able to take out for long-term care if you have the rider is 200000 if your insurance company allows 80. Each companys policy offers unique benefits and it is difficult to know which combination long term care life insurance company or stand alone will be the best choice for you.

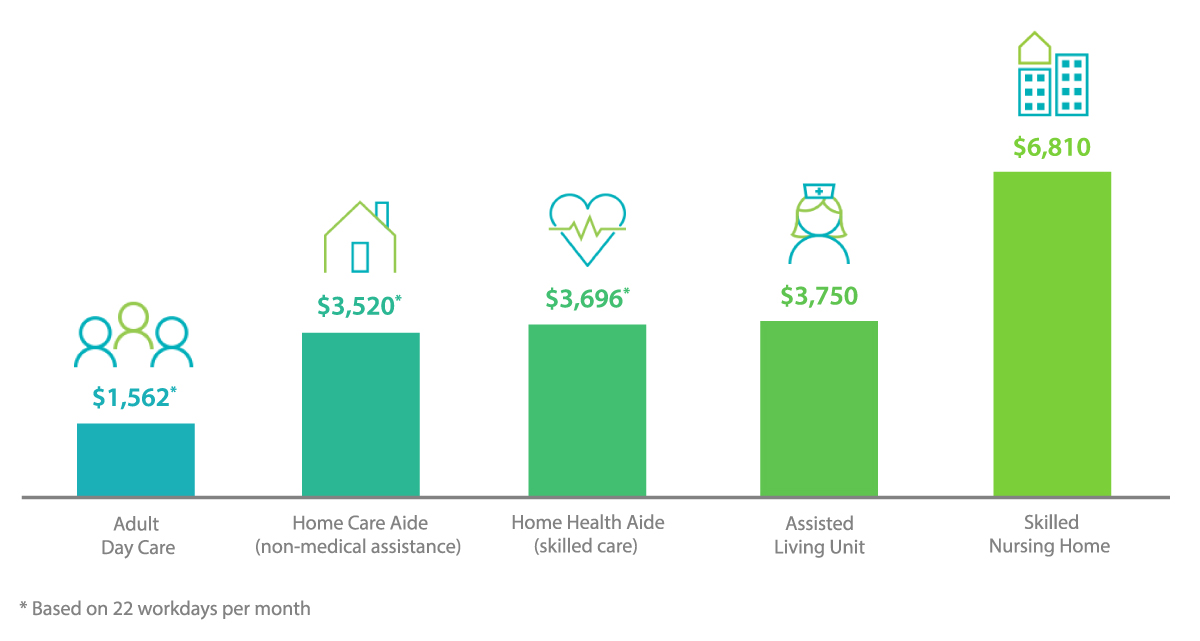

After all Long Term Care is on a lot of peoples minds. Posted on May 4 2018 Leave a Comment. My mother was in a nursing home for about two years prior to her death and it cost the family most of her savings.

October 19 2018. On June 15th 2018. Some insurers now offer cash rich whole life insurance policies with an option to add long-term care benefits.

These riders are. Life Insurance Products with Long-Term Care Riders. The death benefit can then be used to pay for long-term care expenses.

2 As these insurance products are doing double duty ie one policy or product offering the potential for two kinds of coverage their premiums are costlier than that of a standalone LTC policy. Current costs for long term care facilities can run anywhere between 80000 150000 annually in a semi-private or private nursing home. If you have a high risk of requiring long-term care a hybrid policy may not be the best solution since you might not get enough coverage for long term care and youll end up paying out-of-the-pocket or asking family members to take care of you or for financial help.

Should you consider buying life insurance with a long term care rider. Monthly allowed amounts vary but could range from 1 to 4 of your death benefit. Our Top 7 Best Hybrid Long Term.

Other insurance products feature similar riders. Meet Mark Gowin Blog Contact Moneywise. Continuing from the previous example if the life insurance policys extension of benefits rider increases the long-term care benefit the death benefit87000remains the same to three times the death benefit 261000 the monthly amount available for long-term care increases to 7830.

If you are a baby boomer and you have kept your eye on it for a few years chances are you have noticed this. On the other hand if the extension of benefits rider extends the length of time the monthly long. If you are a baby boomer and you have kept your eye on it for a few years chances are.

I dont want the same to happen to me and my husband. Its a big d. Who Will Pay Your Long Term Care Expenses Part 2 of 3.

Moneywise with Mark Home Services. With this type of benefit called an indemnity style rider you dont need to submit bills and receipts each month. Including the long term care rider with your life insurance policy may help reduce the financial responsibility of your family and friends to provide for you as you age.

Military to Civilian Social Security Classes Retirement Income Planning Holistic Financial PLanning 401k403b Rollovers Testimonials About. Provided by Greg Ferguson. The price of long-term care insurance has really gone up.

With so many people needing long term care these days consumers are asking lots of questions about how to protect what they own if they need expensive long term care services in the. To qualify for the rider you must be unable to independently perform two of the. A long-term care LTC rider is a life insurance policy feature that allows you to receive a portion of the death benefit while you are still alive.

Life Insurance with a Long Term Care provision is something you may want to consider. If you qualify for the long-term care benefit via your LTC rider your life insurer may distribute up to the allowed amount which may be set as a lump sum or as a percentage of your policys death benefit each month. When comparing ltc insurance vs life insurance with ltc rider consider your long-term care need.

Are they worthwhile alternatives to traditional LTC policies. Other insurance products feature similar riders. A Simple Solution - The Long Term Care Rider Adding a LTC rider1 allows an insured or policy owner the ability to access benefits from the life insurance policy while still alive.

Life Insurance Products with Long-Term Care Riders Submitted by Ferguson Financial Inc. Learn more about long term care coverage. Each long term care insurance company below offers either a linked benefit combination policy life insurance with long term care rider or a stand alone long term care insurance policy.

I know that you. Therefore we are trying to make the decision of buying either long-term care insurance or life insurance with a long-term care rider to pay for long-term care. With the addition of LTC riders to life insurance policies clients now have more affordable options for covering not only needs that arise from death but needs that arise during incapacity as well.

A recent survey shows that more than 52 of Americans will require long term care at some point in their lives. Life insurance with long term care rider.

Long Term Care Insurance New Jersey Gladstone Coverage Group

Top 10 Best Long Term Care Insurance Companies

Long Term Care Rider Vs Chronic Illness Rider Top Benefits Of Each

Hybrid Life Insurance Policies Increasingly Popular As Long Term Care Funding Strategy

Washington S Long Term Care Payroll Tax And How To Opt Out Alterra Advisors

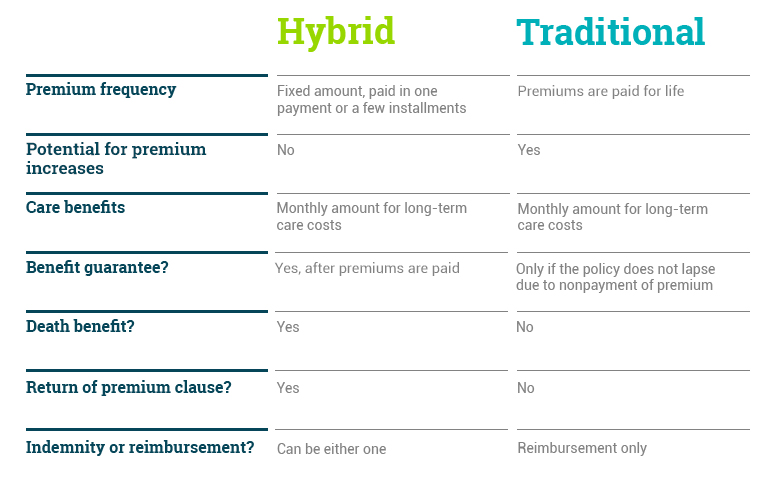

What Is Hybrid Long Term Care Insurance Brighthouse Financial

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

Top 10 Best Long Term Care Insurance Companies

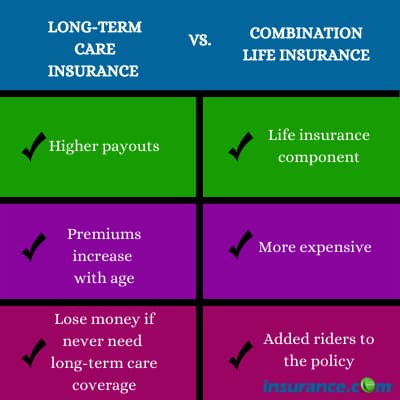

Long Term Care Insurance Vs Combination Life Insurance

Long Term Care Rider Vs Chronic Illness Rider Top Benefits Of Each

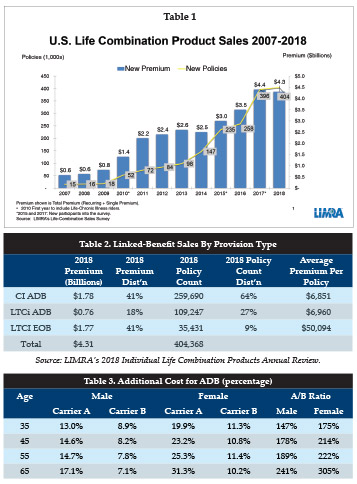

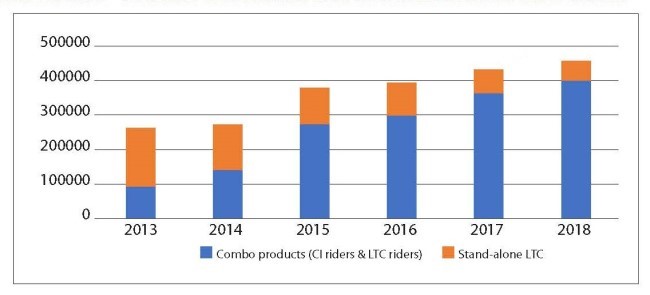

The Combination Life Insurance Market Continues To Grow And Evolve Broker World

Long Term Care Insurance Products And Addressing The Use It Or Lose It Concern American Academy Of Actuaries

Carrier Spotlight New Ltc Rider From Mutual Of Omaha Pinney Insurance

Long Term Care Rider Long Term Care Riders Explained Mason Finance

What Is Hybrid Long Term Care Insurance Brighthouse Financial

How Hybrid Life Insurance Pays For Long Term Care Forbes Advisor

Life Insurance With Long Term Care Benefits Symphony Financial Planning

Life Insurance With Long Term Care Benefits Symphony Financial Planning

Post a Comment for "Life Insurance With Long Term Care Rider 2018"