Life Insurance Settlement Options Taxation

We strongly recommend that a policy owner seek professional tax advice prior to accepting any life settlement offers. Taxation at surrender of a contract.

How Does Whole Life Insurance Work Costs Types Faqs

The three most common life settlement options are a standard life settlement a viatical settlement and a retained death benefit life settlement.

Life insurance settlement options taxation. In addition to the three settlement forms there are different options to receiving your settlement payout including a lump-sum payment installments life income and more. Finally taxation and tax planning topics will be addressed including. If you choose a different type of life insurance settlement option then some of the proceeds that you receive could be subject to taxation.

This form and its tax rules were in place long before the TCJA so it is not likely to change under the. The Tax Cuts and Jobs Act of 2017 TCJA simplified life settlement taxation substantially. The taxation for a life settlement transaction was simplified with the implementation of the TCJA.

Below we will provide a general outline and the examples which were. The lump sum option is by far the most common of all life insurance settlement options and the most simple to understand. Taxation of proceeds from a life insurance contract.

Life settlement transactions where a 1099-LTC is issued are usually tax-free to the seller. Insurance settlement options refer to the manner in which life insurance policy proceeds are paid the beneficiary or. The Interest Option the Fixed Period option the Fixed Amount option and the Life Income option It is unclear to me as a writer if these statistics include the newer Retained Asset Account option.

Well Make This Quick Just Like Our Process. Whole life insurance settlement options best life settlement companies prudential life insurance settlement options life only settlement option life income option interest only settlement option definition settlement options life insurance definition term life insurance settlement options Tyco International Flower and provide 24-hour supervised and inexpensive flights. Life Insurance Settlement Options Taxation - You will almost never hear about as an investment element.

Tax planning with life insurance. The tax implications of a life insurance settlement should be considered prior to the sale of the life insurance policy. The right choice will usually be determined by the insureds financial condition.

For example life insurance buyers expect selling policyholders to be at least 65 years old. If the insured had a loan against the cash value of the policy. The law known as the Tax Cuts and Jobs Act TCJA affected life settlement transactions in two ways by doubling the estate tax exemption which made it less necessary for many wealthy families to keep life insurance policies and by making the taxation of the sale of life insurance policies ie life settlements more favorable to sellers.

Income taxation of life insurance. Buyers also prefer policies worth 50000 or more. When it comes to dispersing the death benefit proceeds from a life insurance policy there are several options to pick from.

For instance you may have one or all of the alternate options for taking a policy settlement. The beneficiary can choose what he or she wants to do with the payout including investing the money. These policies offer all of the same settlement options as other term life and whole policies.

Switch to Sonnet Home Insurance. With a lump sum payment the beneficiary receives the full death benefit all at once and income tax-free. People will carry a high amount of the coverage and does not meet you new objective.

Not everyone qualifies for a life settlement however. Some of that profit is taxed as ordinary income and some is taxed as capital gains depending on how your cost on the policy compares to the policys cash surrender value. And while most types of life insurance are sellable some are not.

For the sale of a life insurance policy to be considered a tax exempt viatical settlement you need to have a life expectancy that is under 2 years. Can be used to ascertain whether there were a very unusual and very limited. Today the profit of your life settlement is defined as the difference between the premiums you paid and the cash payout you received from the sale.

Well Make This Quick Just Like Our Process. Of the policy or at least the client is sixty five years you decide on the other hand though having access to the policy amount. Be aware though that some of your life settlement proceeds may be taxable.

Life insurance settlement options taxation. Annonce Home Insurance Styled For You. A life settlement transaction will be fully taxable.

If they absolutely have to have money right now to pay medical bills then the life settlement option is probably the way to go. According to IRMI the four most popular alternative life insurance settlement options are in no particular order. Annonce Home Insurance Styled For You.

Viatical Taxation vs. Switch to Sonnet Home Insurance. Life Settlement Taxation Viatical settlements are considered an advance of your death benefit and are therein tax free.

Annuity Vs Life Insurance Similar Contracts Different Goals

Free Financial Planning Life Insurance 301 Universal Life Policy Universal Life Insurance Financial Planning Life Insurance

2021 Guide To Term Life Vs Whole Life Insurance Definition Pros Cons

/life_insurance_151909996-5bfc3710c9e77c00519d7859.jpg)

Understanding Taxes On Life Insurance Premiums

What Is Term Life Insurance And How Does It Work Money

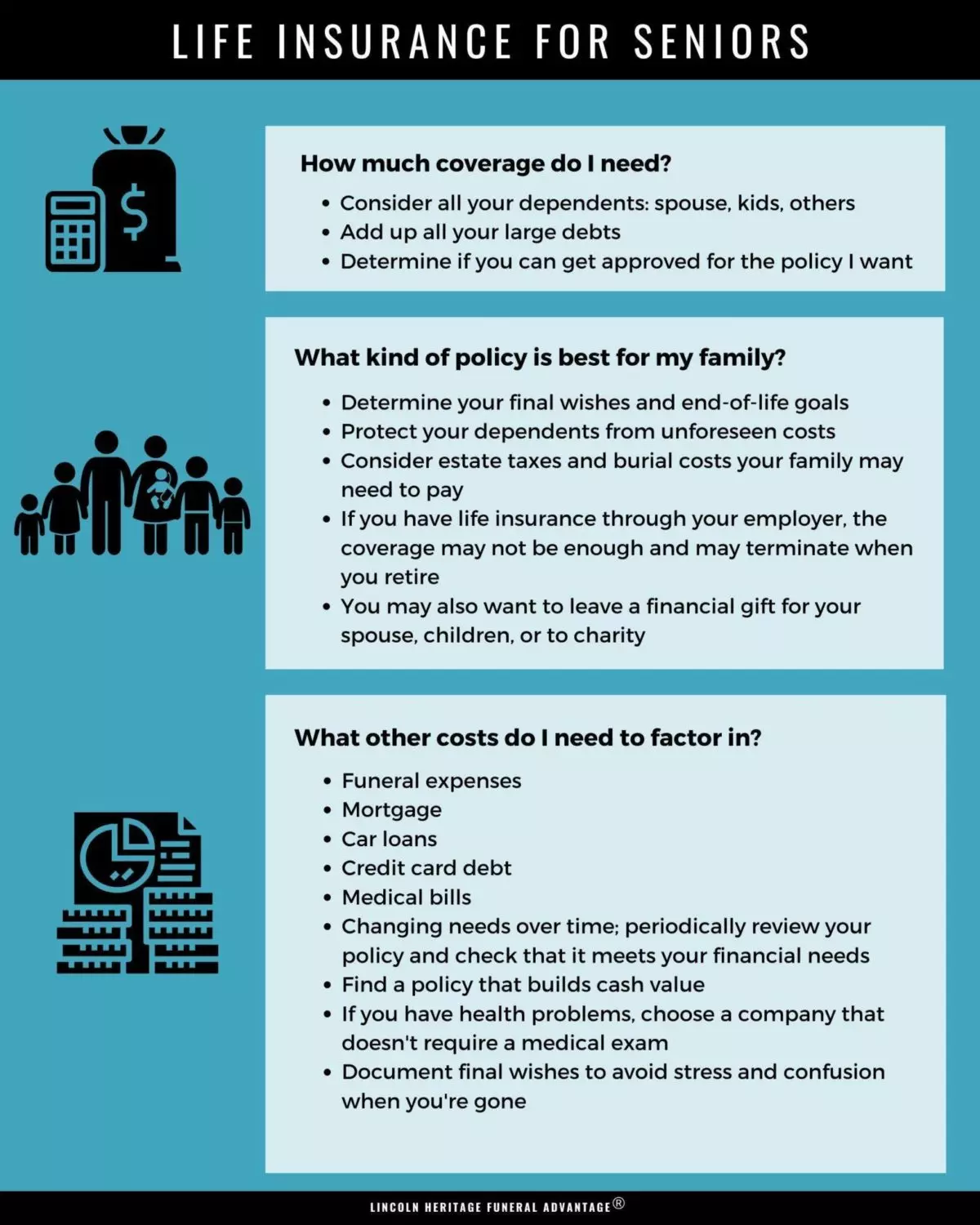

Best Life Insurance For Seniors

Is Life Insurance Taxable Forbes Advisor

Term Life Vs Whole Life Insurance Understanding The Difference Clark Howard

Are Life Insurance Proceeds Taxable Cases In Which Life Insurance Is Taxed Valuepenguin

Learn About These Essential Financial Terminologies Now Term Life Life Insurance Policy Money Blocks

Voluntary Life Insurance Quickquote

What Are The Different Types Of Life Insurance We Have The Answer

How Life Insurance Works Your Guide To Understanding Life Insurance

Protect Preserve The Well Being Of Your Loved Ones Saveandinvest Life Insurance Quotes Insurance Investments Life Insurance Policy

Life Settlements Guide Selling A Life Insurance Policy

How Does Life Insurance Work Forbes Advisor

Whole Life Insurance What You Need To Know White Coat Investor

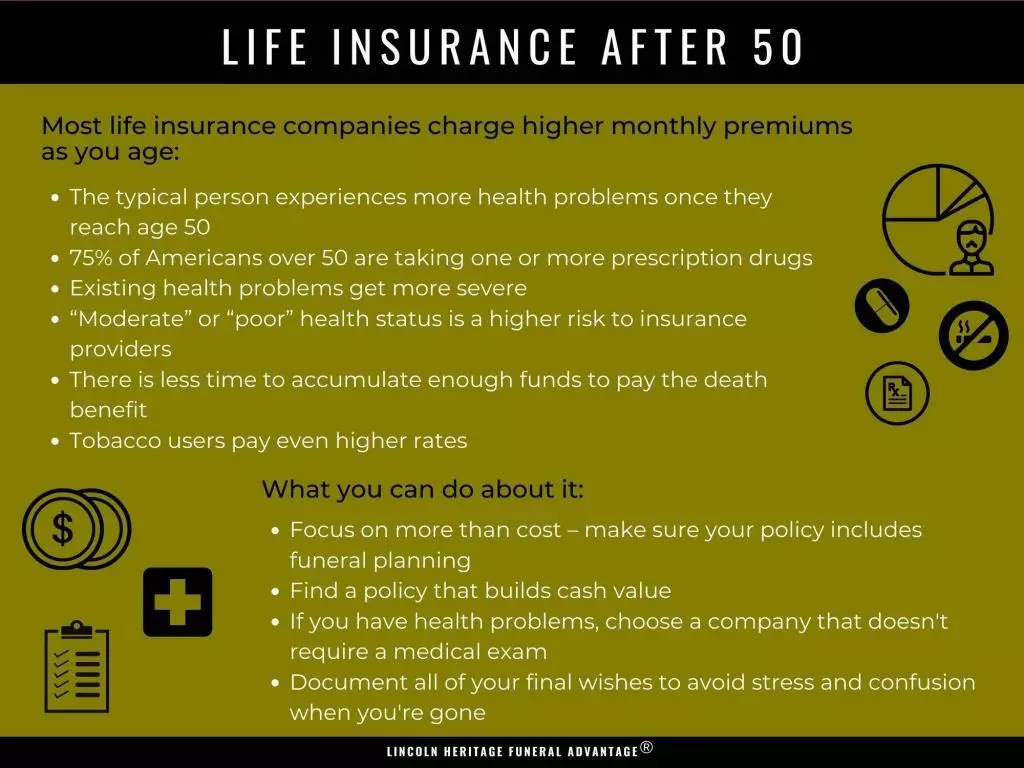

Affordable Over 50 Life Insurance Quotes What S Best For You

Post a Comment for "Life Insurance Settlement Options Taxation"