Life Insurance Payout Breast Cancer

In 2015 the youngest claimant was 31 and in 2007 a 24-year-old was the youngest employee to make a breast cancer claim. With the number of advances in treatments life insurance companies are making adjustments to their underwriting guidelines making it easier to find coverage.

You may be required to provide medical records.

Life insurance payout breast cancer. In the case of breast cancer if you have an early-stage form you may have to wait anywhere from several months to 10 years after treatment before you can get life insurance. Underwriting Breast Cancer. If you are currently in treatment for cancer you cannot get traditional life insurance.

For Critical Illness Cover there could be an increase in the premium or an exclusion may be placed on your cover. Finding life insurance as a breast cancer survivor isnt impossible. 36 of life claims paid in 2016 were due to breast cancer.

In fact many wait too long and end up getting very high rates because of health conditions like breast cancer. Cancer also known as carcinoma is the abnormal or malignant growth of cells which spread throughout the body destroying healthy tissue. Yes but it depends on where you are in your recovery process.

Offer coverage as normal. Whether youll get get accepted for a life insurance with cancer. When you apply for life insurance the life insurance company evaluates your application to determine how much risk you are to insure.

It could also pay for your funeral costs. Today insurance companies now make it possible so breast cancer survivors can secure life insurance. For more information visit the Protective Life.

Similarly the payout could be a way of providing money for your family after you die. If your breast cancer was ER-Positive standard life insurance rates are possible. Best Life Insurance Companies For Breast Cancer.

Breast Cancer Life Insurance The Insurance Surgery is a leading insurance specialist helping clients and their families suffering from medical conditions that affect their insurance such as breast cancer. If you are in remission consider the following for term life insurance. Can I get life insurance if Im diagnosed with breast cancer.

Successfully treated cancer however is a different story. Life Insurance after cancer is possible because of the advances in treatment. This process is called underwriting.

Typically payments are limited to the. The average age of claimant for a breast cancer critical illness claim was 49-years-old in 2016 and the youngest claimant was 37 years of age. Yes but it depends on where you are in your recovery.

Can anyone get life insurance with cancer. After a breast cancer diagnosis the insurer may choose from one of 4 options when choosing whether or not to extend coverage. As a rule life insurance plans will pay out for most diseases that are beyond your control like breast cancer.

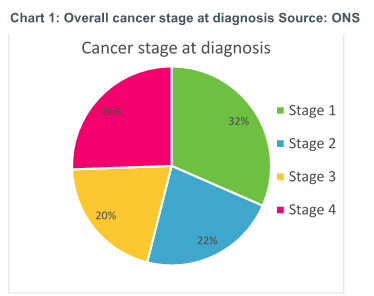

The main reason you might like to have life insurance after cancer is that the payout could pay off your debts if you passed away such as your mortgage. Critical illness insurance covers all life-threatening cancers leukemia lymphoma Hodgkins disease as well as tumours in the presence of human immunodeficiency virus HIV. If you have stage 3 breast cancer it may be 10 to 15.

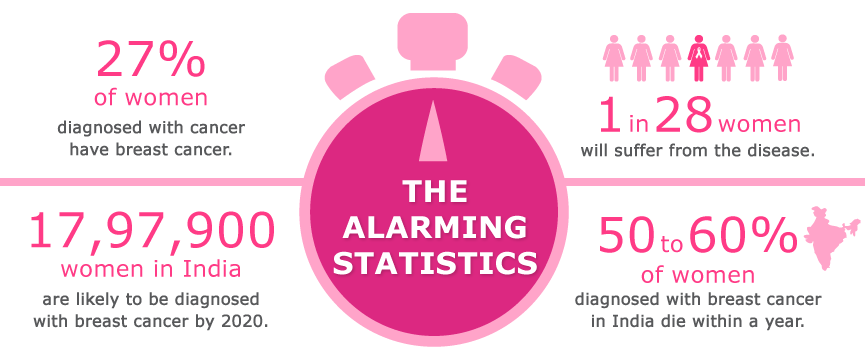

If your diagnosis doesnt affect your long-term risk you may be eligible for typical coverage. With over 50000 cases diagnosed every year there are a significant number of people with breast cancer that the Insurance Surgery has helped to find low cost insurance policies for. Terminal life insurance payout.

This is because nearly all insurers now pay out if in situ breast cancer is diagnosed resulting in a mastectomy lumpectomy or a wide local excision. Can I get life insurance if Im diagnosed with breast cancer. Life insurance purchases happen all the time after a breast cancer diagnosis.

When youve been cancer-free for five years or so you may qualify for a rate reduction. For example inherited conditions like certain types of bowel breast or ovarian cancers will be considered during the underwriting process. Other conditions like obesity or high blood pressure.

A provider will want to understand the treatment you have received eg mastectomy lumpectomy and the severity stage of your diagnosis as part of the application process. I too have just been diagnosed with secondary breast cancer in my lungs which can be managed and not cured. Life insurance is substantially more affordable if you buy it when you are young and healthy.

Offer coverage as normal. There are many life insurance companies that can help you select the right type of life insurance policy based on. Fortunately there are enough insurance products out there that will accommodate your situation so that you will not be the one who leaves the cost of final expenses to surviving loved ones.

The longer its been since youve had the treatment without any further issues. Generally speaking the following are favorable to a life insurance application. For life insurance it may affect the premium that you pay.

If not ER-Positive most insurers will postpone offering life insurance for 1-2 years after all treatment. Some life insurance companies underwrite a history of breast cancer more favorably than others. And then youll most likely have to pay more for your coverage for a while.

This article looks at some of the basics when applying for life insurance coverage as a breast cancer survivor. Cancer is a general term used to describe a wide variety of growths some less serious. A temporary flat extra 3-5 years of 500-750 per every 100000 of life insurance.

I have a life insurance policy with Scottish Widows for my mortgage their criteria is a year or less so now have to ask my oncologist the question. Due to advancements in medical treatment life insurance is becoming more and more obtainable for anyone diagnosed with breast cancer. When it comes to underwriting applicants who have a history of breast cancer.

After a breast cancer diagnosis the insurer may choose from one of four options when extending coverage.

The True Cost Of Breast Cancer In Singapore The Care Issue

How Should Protection Providers Respond To The Latest Cancer Figures Hymans Robertson

Can I File A Lawsuit For A Breast Cancer Misdiagnosis

The True Cost Of Breast Cancer In Singapore The Care Issue

Do You Know Someone Maybe A Family Member That Has Unexpectedly Suffered From A Critical Illness Wou Critical Illness Insurance Cancer Patients Cervix Cancer

Breast Cancer Changes Everything Legal General

An Overview Of Breast Cancer Insurance In Singapore

Breast Cancer Insurance Coverage Aynjil

Breast Cancer Life Insurance Breast Cancer Survivor Life Insurance Quickquote

Can I Get Critical Illness Cover For Breast Cancer Lion Ie

What Insurance Should I Get Vs Breast Cancer Holborn Assets Holborn Assets

Http Linkedin Com In Brandi Cooksey 02733612a Aflac Aflac Insurance Cancer Care

Buying Life Insurance After Cancer Forbes Advisor

Pin On Breast Cancer Kit Care Packages

Post a Comment for "Life Insurance Payout Breast Cancer"