Life Insurance Beneficiary Payout Options

This option allows you to receive a life insurance payout in installments. The specific life option allows the beneficiary to give the insurance company a payout schedule to follow.

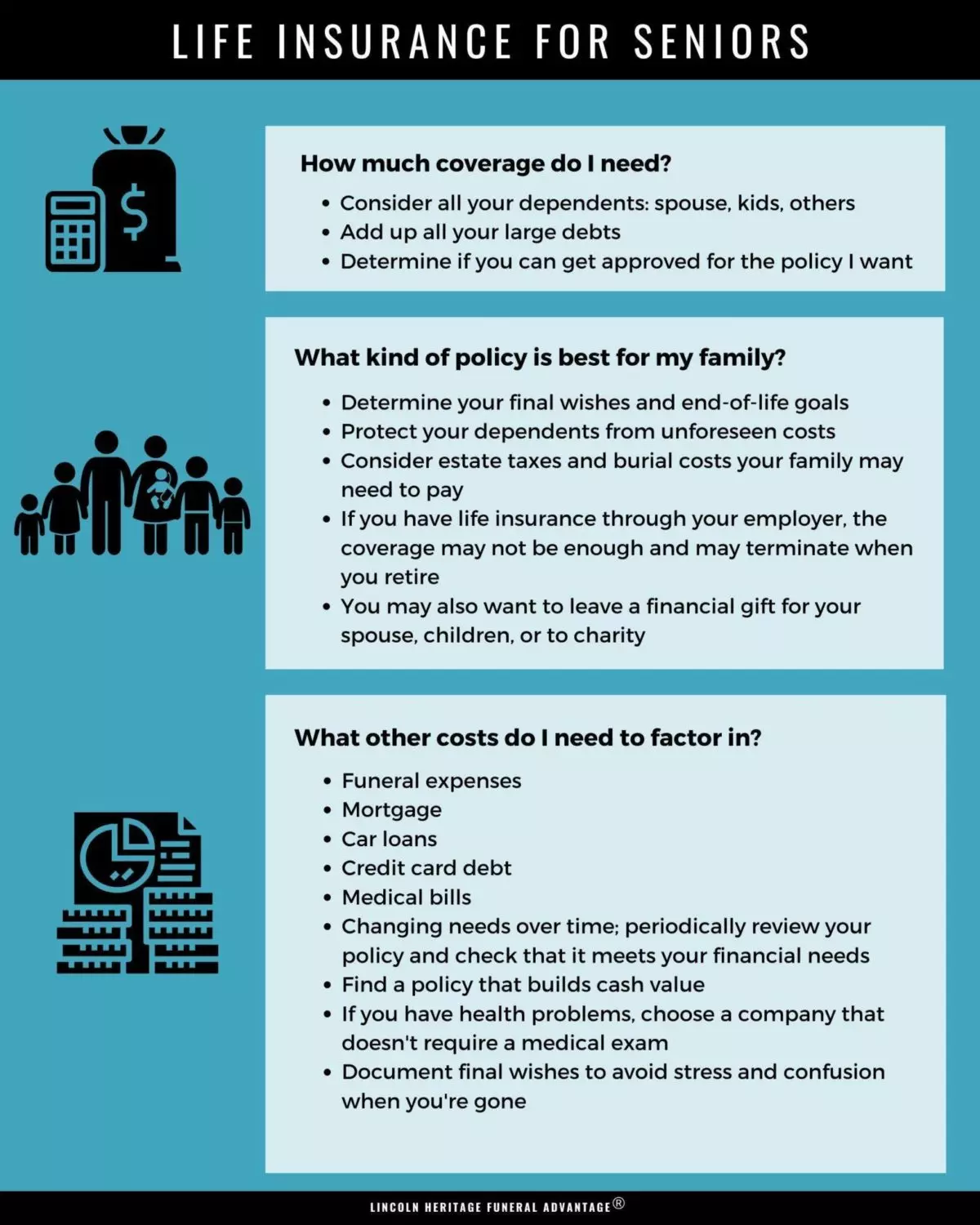

Best Life Insurance For Seniors

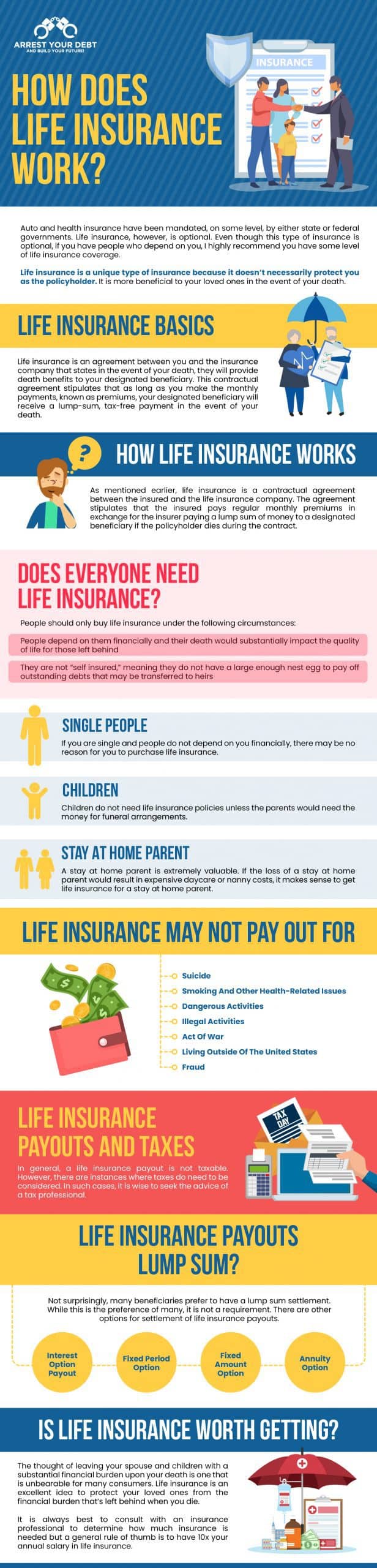

Tax Rules for Life Insurance Payouts The tax rules for life insurance payouts are straightforward.

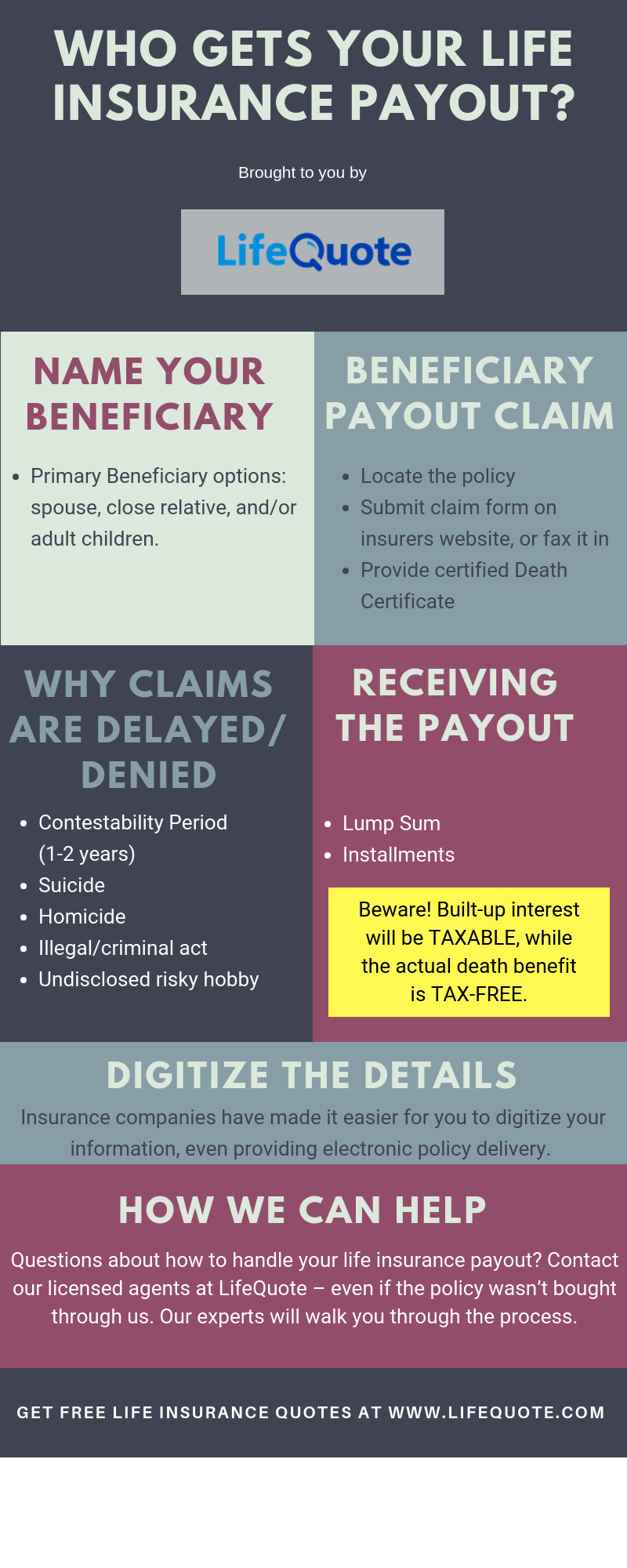

Life insurance beneficiary payout options. If the beneficiary dies before the period is over a secondary beneficiary will receive the rest of the payments. Types of Insurance Payouts In most cases beneficiaries choose the type of life insurance payout after the insured dies. Life Healthcare 1 days ago 62 People Used See more.

If theres more than one each beneficiary has to submit their own claim. Unlike with a life income option you can choose the time period over which you want to. How Does Life Insurance Work.

There are different ways a beneficiary may receive a life insurance payout including lump-sum payments installment payments annuities and retained. If youre a life insurance beneficiary you. All death benefit proceeds are unconditionally free from income taxes regardless of when the death benefit is paid who receives it and how it is used.

Installments Annuities and Other Payout Options. Whole Life Insurance Payout Options Jun 2021. This offers quick access to the funds of the life insurance policy which allows your beneficiaries to pay off large costs like mortgages quickly eliminating interest costs in the future.

You can select more than one beneficiary. If the policyholder dies while the life insurance policy is still active the. The most common option for receiving a life insurance payout is as a Lump Sum in which the entire face amount is paid to the beneficiary at once.

The life insurance payout will be sent to the beneficiary listed on the policy. Since lump-sum payments arent for everyone life insurance companies offer several other payout options. Guaranteed periodic payments over the beneficiarys lifetime.

A beneficiary is the person or entity that receives a payout from an active life insurance policy after you die. For example if you name your spouse and two children as beneficiaries you might want your spouse to have 50 of the death benefit and let your two children split the remaining 50 by giving each child 25 you have total control here as long as your life insurance payout totals 100. Understand the different payout options.

When choosing a beneficiary it is important to consider who will be financially impacted by your death. This one is a little different from the rest of the payout options because its actually chosen by the insured not the beneficiary. It is distributed to beneficiaries income tax-free and there are no restrictions for how those proceeds are used.

As the beneficiary you can choose how you want to receive the proceeds so its crucial to be aware of the options that are available. Onetime income tax free payment. Payout options include lump-sum payments installments and annuities and a retained asset account.

Generally a life insurance death benefit can be paid out in the form of a lump sum as an annuity or in the form of regular installments. Which Life Insurance Payout Option Should You Choose. Then the insurance company will pay each person or organization the amount the policyholder left them.

The entire benefit amount is paid at once by check or electronic transfer. With a 100000 death benefit the beneficiary can choose to receive 10000 per year or another amount. Beneficiary Options Rights and Benefits A life insurance beneficiary is the person that receives the payout from a life insurance policy and must be selected by the insured person at the time that the contract is signed.

Life Insurance Payout to Beneficiaries Today with life insurance upon the death of the insured a lump sum payment or installments are paid to the beneficiaries. The policyholder may decide for any number of reasons that they want their death. After purchasing a life insurance policy the policyholder will make recurring premium payments to the life insurance company to maintain coverage.

Beneficiary Options Rights and Benefits A life insurance beneficiary is the person that receives the payout from a life insurance policy and must be selected by the insured person at the time that the contract is signed. Life Auto Home Health Business Renter Disability Commercial Auto Long Term Care Annuity. Whether you are a policyholder or a beneficiary heres what to know about life insurance payouts and life insurance settlement options.

Insurers typically offer a variety of payout options for life insurance death benefits.

How Does Life Insurance Work Complete Guide Arrest Your Debt

Who Gets Life Insurance Payout Make Sure Your Beneficiary Gets Paid

How Life Insurance Works Your Guide To Understanding Life Insurance

Protect Your Family With An Affordable Life Insurance Policy In 2020 Affordable Life Insurance Life Insurance Facts Life Insurance Policy

Voluntary Life Insurance Overview How It Works Types

How Does Life Insurance Work Forbes Advisor

What Is Life Insurance And How Does It Work Money

What Is Life Insurance Exact Definition Meaning Of Life Insurance

Annuity Assist How Annuities Work Infographic Annuity Finance Investing

What Is Term Life Insurance And How Does It Work Money

Amplify What Is Life Insurance All About We Spill The Secrets Benefits On Why This Financial Planning Tool Is Your Next Best Move

Annuity Vs Life Insurance Similar Contracts Different Goals

How To Find Out If Someone Has Life Insurance

What Is Life Insurance Exact Definition Meaning Of Life Insurance

Things You Should Know Before Cancelling Your Life Insurance Policy Sell My Life Insurance Policy

Key Benefits Downside Of Annuity Annuity Guaranteed Income Financial Planner

Life Insurance Google Search How To Plan Term Insurance Health Insurance Humor

:max_bytes(150000):strip_icc()/GettyImages-1199059338_journeycrop_lifeinsurance-d3498103ef78406991ea4b4a7b401266.jpg)

Post a Comment for "Life Insurance Beneficiary Payout Options"