Life Insurance For Breast Cancer Survivors Uk

Around 95 out of every 100 women around 95 survive their cancer for 1 year or more after diagnosis Around 85 out of every 100 women around 85 will survive their cancer for 5 years or more after diagnosis. With the number of advances in treatments life insurance companies are making adjustments to their underwriting guidelines making it easier to find coverage.

Effects Of Housing Value And Medical Subsidy On Treatment And Outcomes Of Breast Cancer Patients In Singapore A Retrospective Cohort Study The Lancet Regional Health Western Pacific

There are three basic types of life policy.

Life insurance for breast cancer survivors uk. Life insurance is helpful for two main reasons. A company has to tailor policies specifically for each breast cancer survivor through a process called underwriting. So it will only pay out if you die within that specific.

This means the insurer will pay out the full amount of the cover straight away if you are expected to live for less than 12 months. Due to advancements in medical treatment life insurance is becoming more and more obtainable for anyone diagnosed with breast cancer. However life insurance providers are unlikely to offer a policy for at least two or three years after youve recovered.

It can pay off debts left behind such as a mortgage. This can happen often if not enough time has elapsed since successful treatment or if your cancer was considered a higher stage or higher risk cancer. Many life insurance carriers offer policies to those recovering from breast cancer but not all.

Encouraging news breast cancer survival rates continue to rise thanks to medical advancements. This article looks at some of the basics when applying for life insurance coverage as a breast cancer survivor. Finding life insurance as a breast cancer survivor isnt impossible.

You can keep the payout even if you live longer. Obtaining life insurance after breast cancer is still completely possible. A temporary flat extra 3-5 years of 500-750 per every 100000 of life insurance is added to the standard rate.

Sometimes when you apply for life insurance with cancer you will need to consider other options such as guaranteed acceptance life insurance. The longer its been since youve had the treatment without any further issues. With TI you can arrange cover that can be as short as 1 month.

If not ER-Positive most insurers will postpone offering life insurance for 1-2 years after all treatment. Accounting for 15 of all cancer deaths in women 3. What is Routes from Diagnosis.

Associated with breast cancer lung cancer prostate cancer and brain and central nervous system tumours. This means that if you passed away as a result of something else youd still be. Most insurers view Cancer life insurance underwriting similarly in terms of when primary treatment ended usually it must be 2 years.

Most applications that we see for Breast Cancer life insurance are accepted with either a loading to the premiums for a period of time following end of treatment or are accepted at standard rates for clients with several. Breast Cancer life insurance rates can vary dramatically from one insurance provider to another and will generally depend on when you received treatment and the period of time in remission. They might be able to find an insurer that can offer life insurance for cancer survivors which excludes the cancer you had.

Life insurance with your cancer excluded. Types of Life Insurance Available to People with Breast Cancer. Term insurance TI This is the most straightforward and usually the cheapest form of life insurance.

A provider will want to understand the treatment you have received eg mastectomy lumpectomy and the severity stage of your diagnosis as part of the application process. Generally insurers will only begin to consider you once you have gone three months since your last cancer treatment although some providers will want to wait a number of years. Cancer sufferers can occasionally obtain life insurance but it is a far rarer occurrence than for cancer survivors.

RfD is a programme of research performing retrospective analysis of almost 85000 cancer patients interactions with the NHS in England over seven years the richest picture yet of cancer survivorship. The policy might contain special provisions and the premium will be based on the risk of. Fortunately insurance companies have changed their way of dealing with cancer survivors.

Breast cancer patients and survivors CAN buy life insurance. How Life Insurance for Breast Cancer Survivors Works. It is a way of protecting.

It can provide money for your family after you die. Breast cancer is the most common form of cancer among woman affecting 21 million women each year. You have to do a lot of research to find which companies do provide coverage and what types of restrictions each one has for breast cancer.

You can get life insurance for cancer survivors by calling the number at the top of the page for guidance or you you can use our online broker form. An experienced insurance broker like myself that is not. Cancer survivor urges people not to rule out life insurance - you may still be eligible LIFE INSURANCE can provide a valuable safety net for those concerned about looking after their loved ones.

Premiums depend on how good they are with the type of Cancer you have or have had. Cancer survivors are defined as those who are either in remission or who have been cured. The key to getting a good deal on life insurance for breast cancer survivors is to understand how companies write such policies.

It can also be a way of saving. You may end up paying more in premiums because youre in a high-risk life insurance category. Life insurance premiums can vary dramatically from one insurance provider to another.

You can use the money for. In many cases cancer survivors are able to take out a life insurance policy. Many life insurance policies include terminal illness cover.

Life insurance can help your family if you die. The specific form of coverage you qualify for is dependent on important underwriting questions. It covers you for a set amount of time.

For more information visit the Protective Life. Is It Possible To Attain Life Insurance After Surviving Breast Cancer. Life insurance underwriters will usually require some key information about your Cancer such as.

Life insurance companies are aware of this and will often approve applications. Stage 1 Breast Cancer Life Insurance Outcomes. Yes you can actually- life insurance for cancer patients is possible.

If your breast cancer was ER-Positive standard life insurance rates are possible. Survival for all stages of breast cancer Generally for women with breast cancer in England. If you have or have had breast cancer you may be wondering if its possible to get life insurance after your fight with the deadly disease.

Uplift Secrets From The Sisterhood Of Breast Cancer Survivors Delinsky Barbara 9781451654677 Amazon Com Books

Can Breast Cancer Survivors Get Life Insurance Accuquote

Breast Cancer Life Insurance Find Cover The Insurance Surgery

Pin On Charity Kestrel Insurance Isle Of Man

Breast Cancer Survival And Survival Gap Apportionment In Sub Saharan Africa Abc Do A Prospective Cohort Study The Lancet Global Health

Male Breast Cancer Survivor On Why Men Fear Emasculating Diagnosis

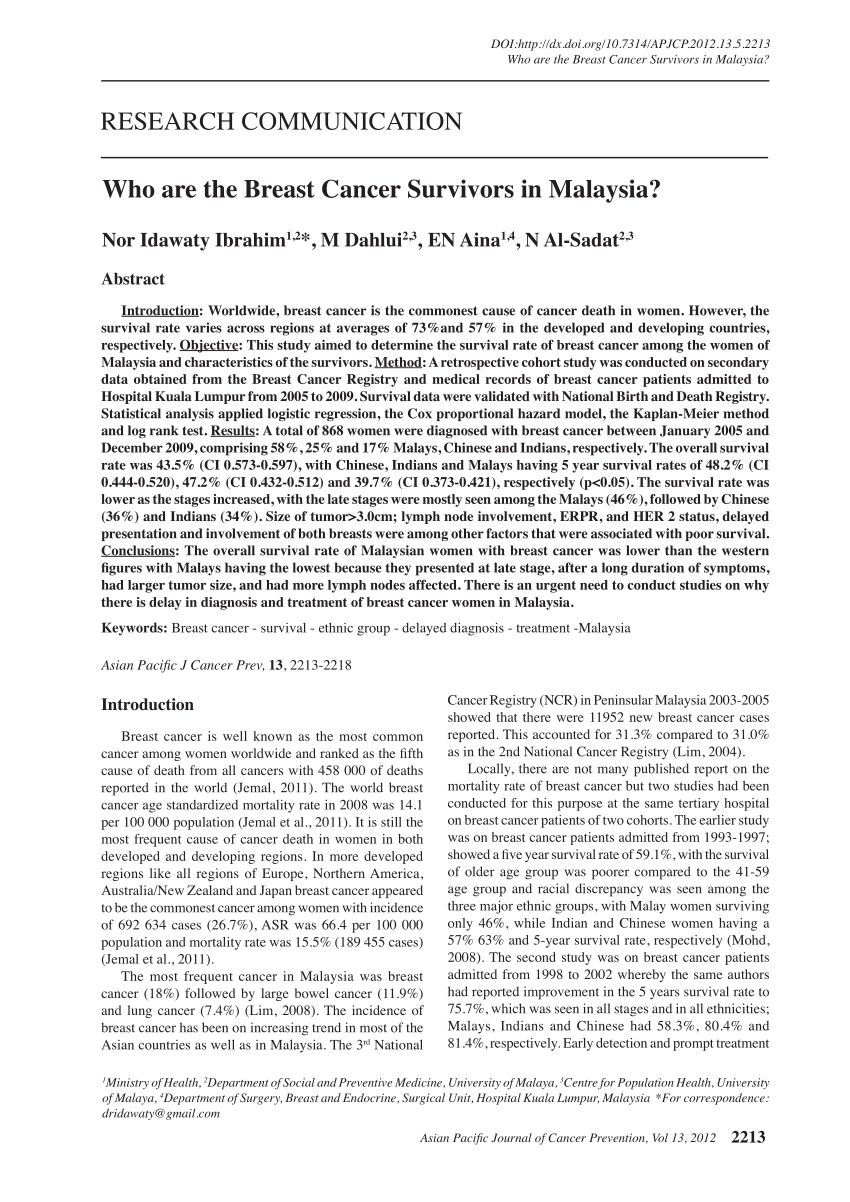

Pdf Who Are The Breast Cancer Survivors In Malaysia

/metastatic-breast-cancer-life-expectancy-4177417-Final-122540acbca343bab8f11d7d928d6c73.jpg)

Life Expectancy Of Stage 4 Breast Cancer

Health State Utilities For Metastatic Breast Cancer In Taiwan The Breast

Posterboards2 Gif 950 633 Infographic Health Health Inspiration Health App Design

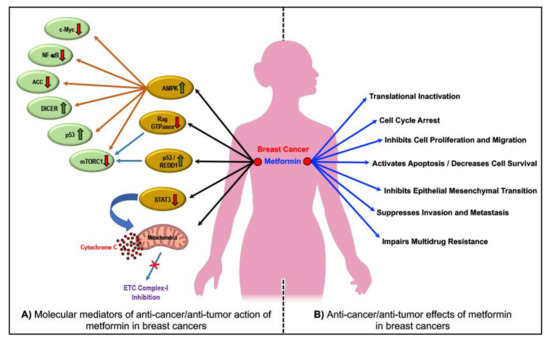

Cancers Free Full Text Counteracting Chemoresistance With Metformin In Breast Cancers Targeting Cancer Stem Cells Html

Breast Cancer Survivors Show That Going Flat After Mastectomy Is Beautiful And Valid

Post a Comment for "Life Insurance For Breast Cancer Survivors Uk"